vermont sales tax exemption certificate

53 rows Exempt from sales tax on purchases of tangible personal property and meals not rooms. The Sales Tax Permit allows you to sell and collect sales tax from taxable products and services in the state while the Resale Certificate allows you to make tax-exempt purchases for products intended for resale.

Vermont Sales Tax Exemption Certificate For Form Agricultural Fill And Sign Printable Template Online Us Legal Forms

Lowest sales tax 6 Highest sales tax 7 Vermont Sales Tax.

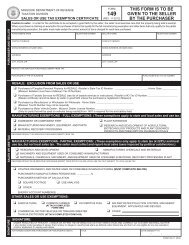

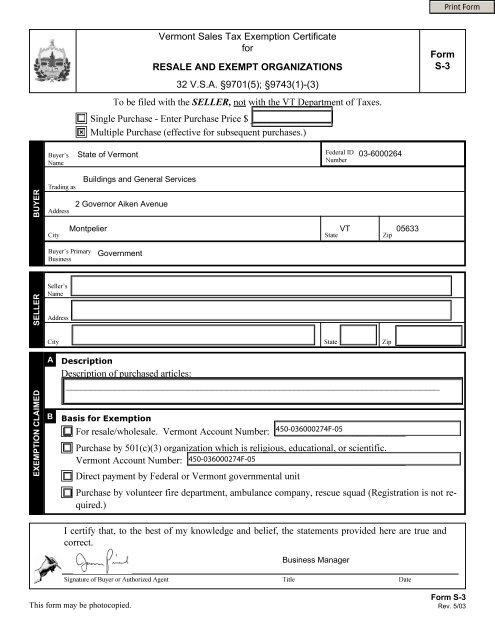

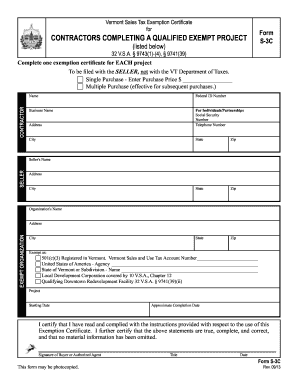

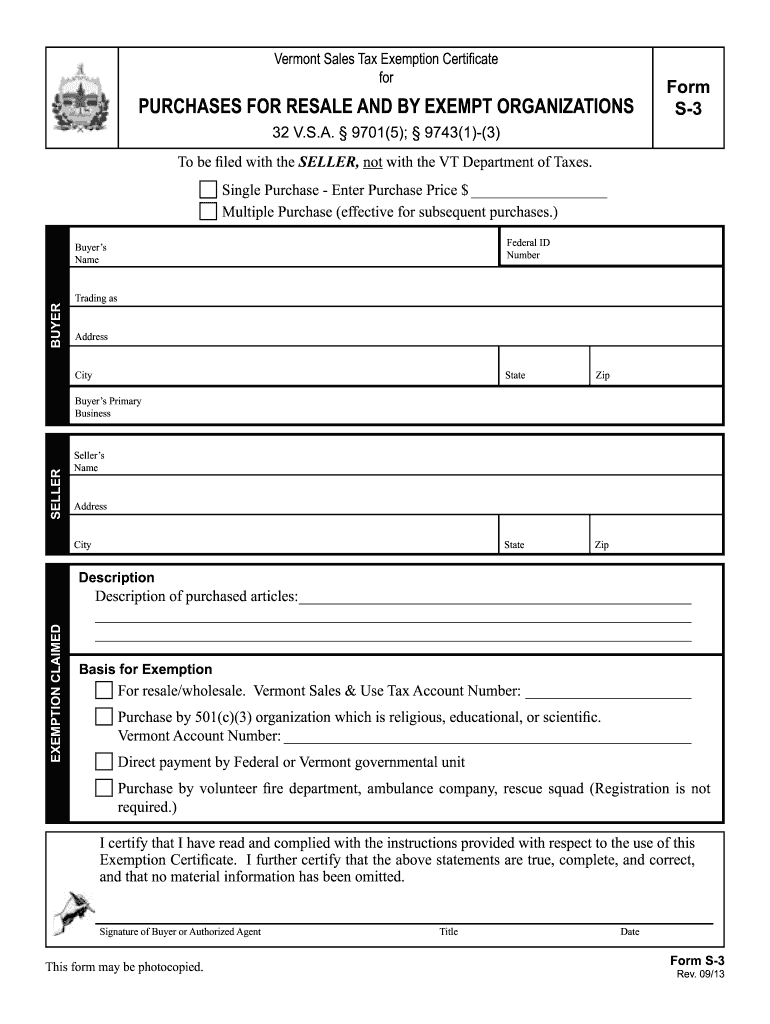

. Print Form Vermont Sales Tax Exemption Certificate for RESALE AND EXEMPT ORGANIZATIONS 32 VSA. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Vermont sales tax. Tax Bulletin 7-11.

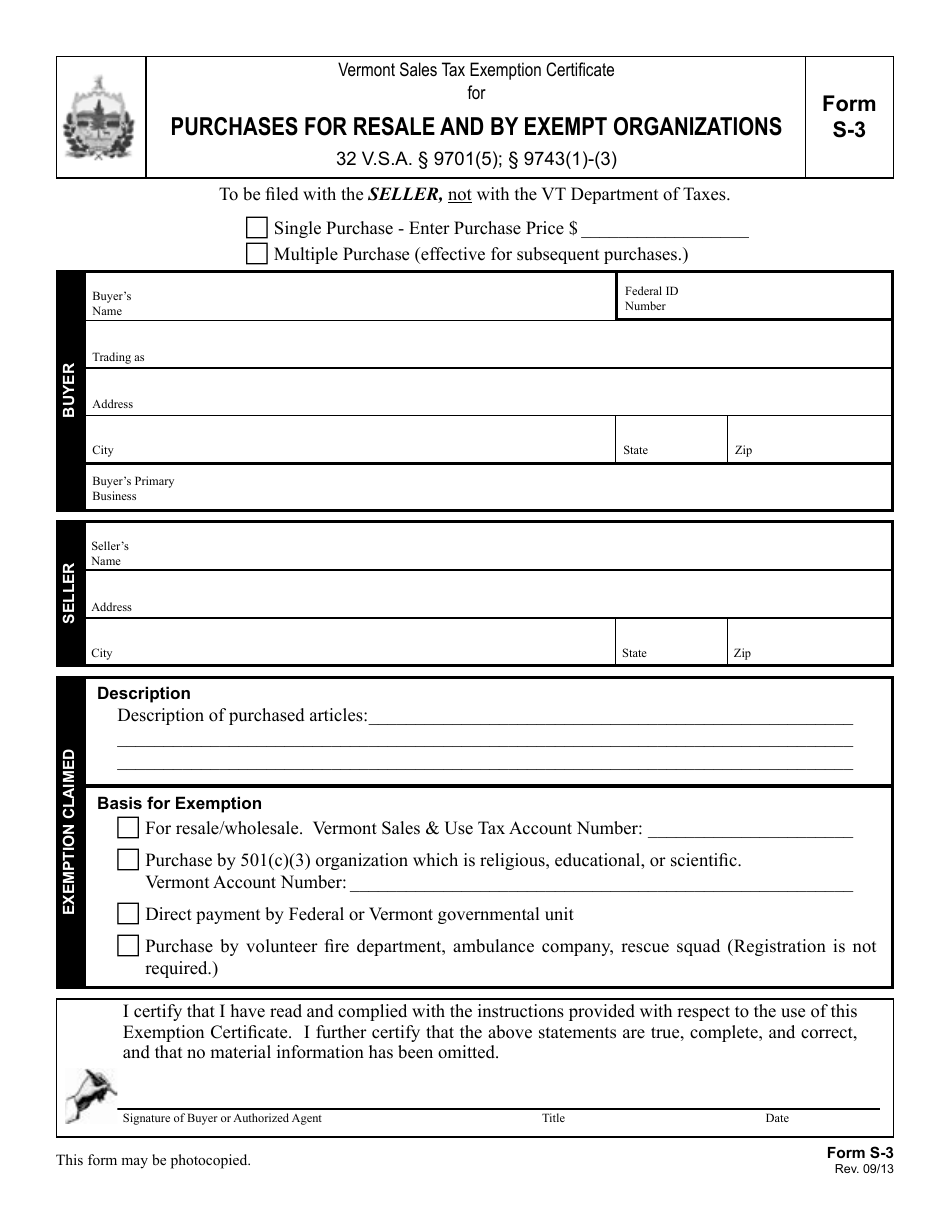

For other Vermont sales tax exemption certificates go here. Vermont Sales Tax Exemption Certificate For Purchases For Resale By Exempt Organizations And By Direct Pay Permit. Business and Corporate Exemption Sales and Use Tax.

With a Vermont Sales Tax Permit youll obtain a Sales Use Tax Account Number for use when filling out the resale certificate. Vermont Sales Tax Exemption Certificate for Form RESALE AND EXEMPT ORGANIZATIONS 32 VSA. Average Sales Tax With Local.

This includes most tangible personal property and some services. A purchaser must give the seller the properly completed certificate within 90 days of the time the sale is made but preferably at the time of the sale. RETENTION OF CERTIFICATES Certificates must be retained by the seller for a period of not less than three 3 years from the date of the last sale covered by the certificate.

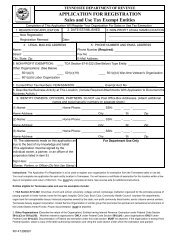

In many states but not all states the purchase of goods and services by state or local governments or by nonprofits are exempt from sales tax. A copy of Exemption Organization Registration Certificate for Vermont Sales and Use Tax or a letter from the Vermont Department of Taxes signed by the Tax Department stating that the organization has been granted exemption status from Vermont Sales and Use Tax as having 501 c 3 status. Area code and number City State ZIP code.

2022 List of Vermont Local Sales Tax Rates. I the purchaser named above claim an exemption from payment of sales and use taxes for the purchase of taxable items described below or on the attached. Erly executed exemption certificates shall be deemed to be taxable retail sales.

A Vermont Certificate of Exemption is a document that allows a business to purchase goods and services tax-free from suppliers for the purpose of reselling those goods and services. The Basics of Sales Tax Exemptions. F or each purchase covered by the exemption certificate the sales slip or invoice must show the buyers name and address sufficient to link the purchase to the exemption certificate on file.

For other Vermont sales tax exemption certificates go here. On making an exempt purchase Exemption Certificate holders may submit a completed Vermont Sales Tax Exemption Form to the vendor instead of paying sales tax. A mom-and-pop market in Vermont decides to stock a new type of beverage and needs to know whether the drink is subject to Vermonts sales and use tax.

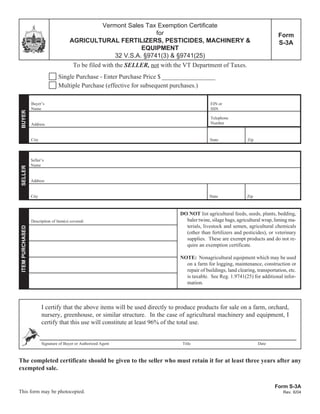

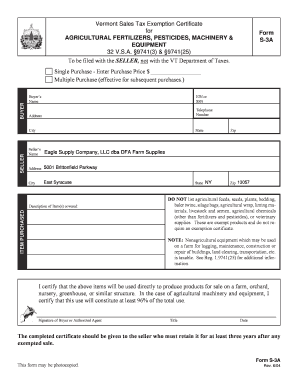

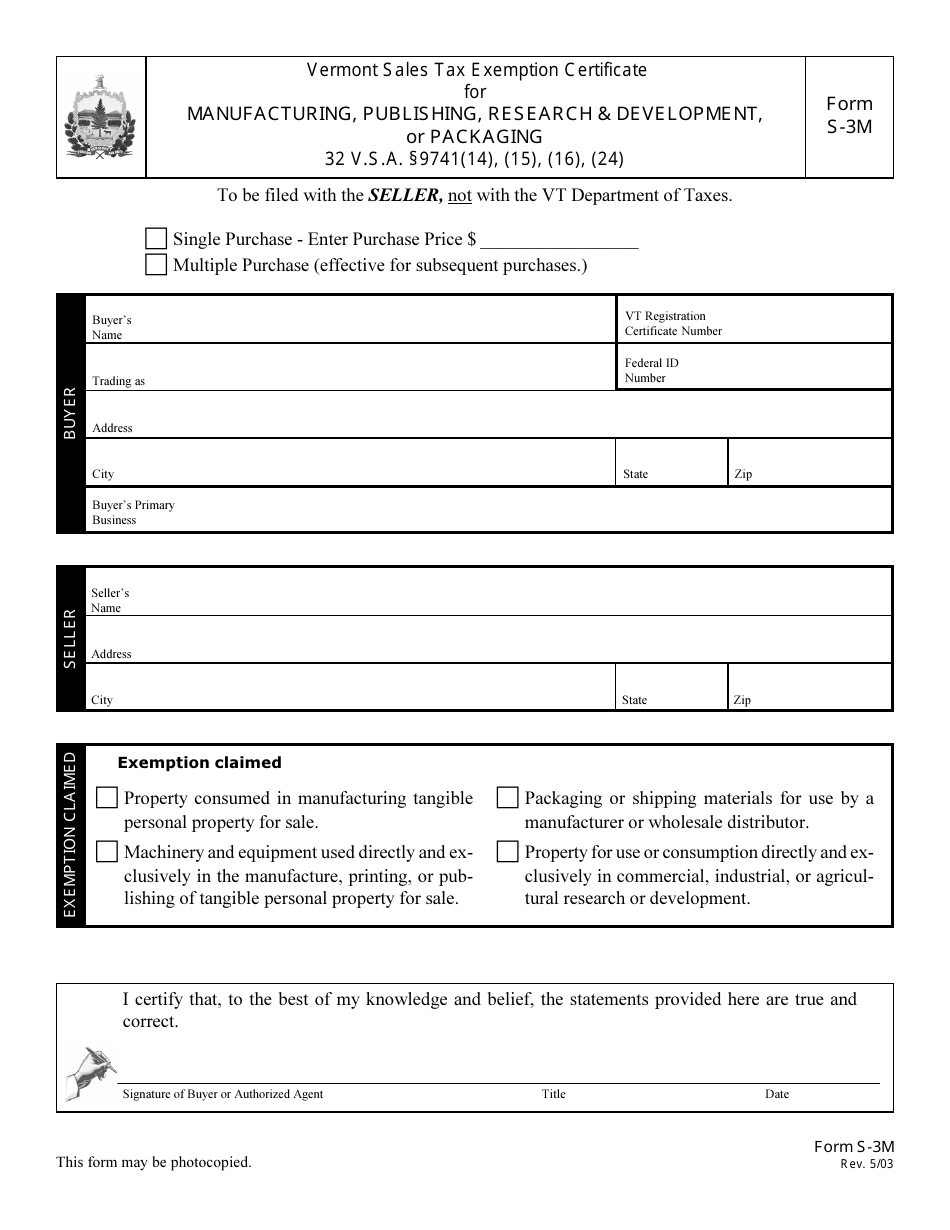

Vermont Sales Tax Exemption Certificate for AGRICULTURAL FERTILIZERS PESTICIDES MACHINERY EQUIPMENT 32 VSA. Tangible personal property for use as indicated on this exemption certificate. There are a total of 153 local tax jurisdictions across the state collecting an.

For example certain states require foreign missions and their members to complete a streamlined sales tax agreement exemption certificate. Form S3 Resale and Exempt Organization Certificate of Exemption is not. S-3pdf 8943 KB File Format.

19242-3 Meals and Rooms Tax TB-13. Form S-3 c Single. Provide vendor with completed Sales Tax Exempt Purchaser Certificate Form ST-5 PDF and copy of Form ST-2 Certificate of Exemption PDF with Renewal Notice Exemption No.

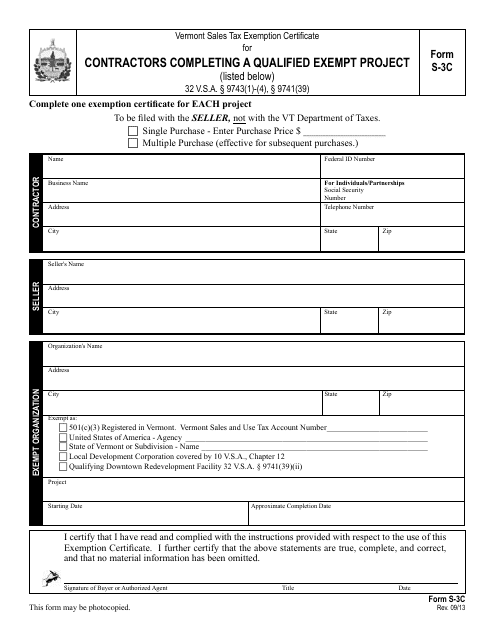

A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases. 97431-3 To be filed with the SELLER not with the VT Department of Taxes. The seller retains the exemption certificate for at least three years from the date of the last sale covered by the certificate.

No exemption from separate MA room occupancy excise tax. Name of purchaser firm or agency. Other types of exemption certificates that may be applicable are available on our website at.

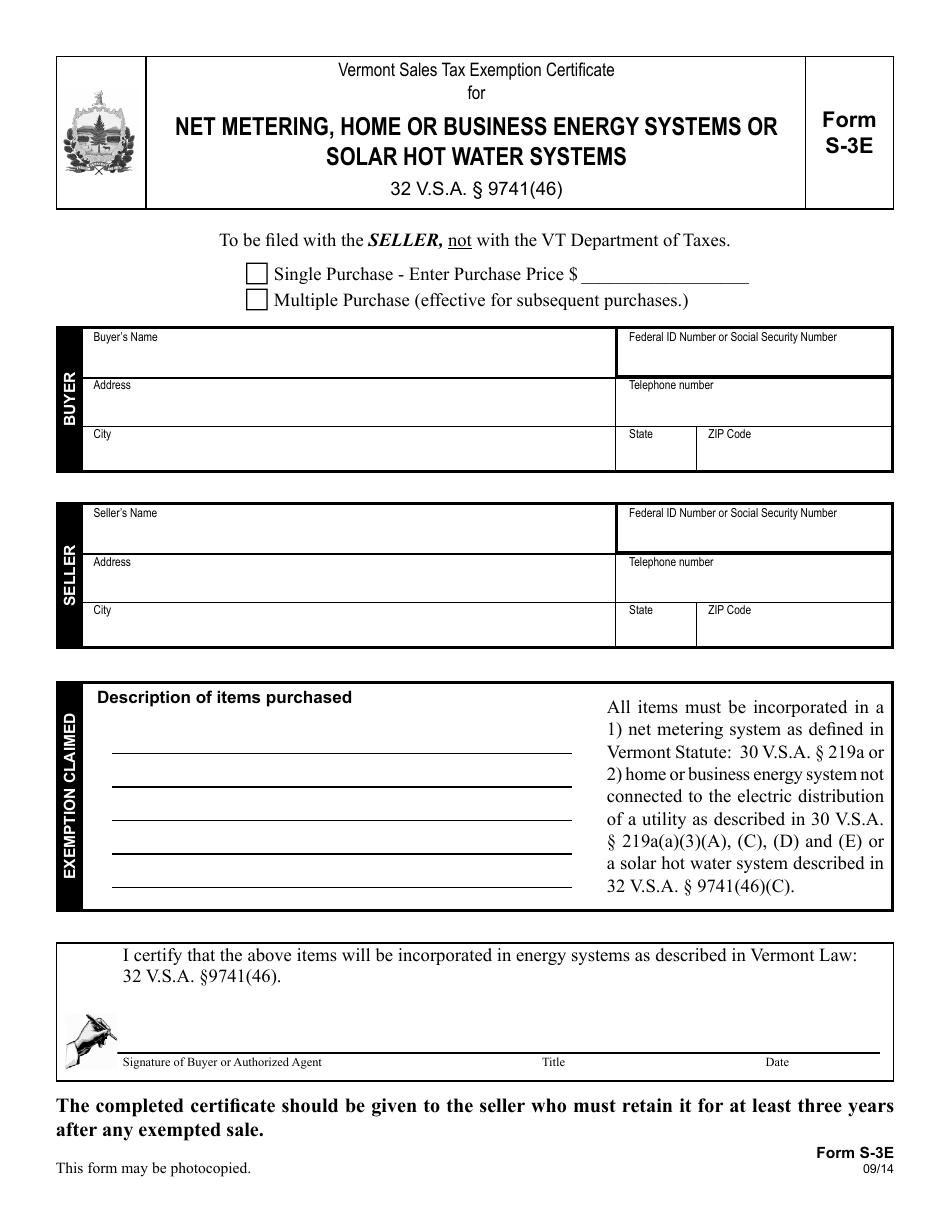

You can download a PDF of the Vermont Streamlined Sales Tax Certificate of Exemption Multistate Form SST-MULTI on this page. Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. SELLER BUYER F Single Purchase - Enter Purchase Price F Multiple Purchase effective for subsequent purchases Buyer s Name EIN or SSN Address Telephone Number City State Zip State Zip Seller s Name Address City ITEM PURCHASED Description of Item s.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to. How to use sales tax exemption certificates in Vermont. View a list of available meals and rooms tax exemptions and exemption.

A sales tax exemption certificate is needed in order to make tax-free purchases of items and services that are taxable. 97431-3 ˇ. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Vermont sales tax.

Get Vermont Sales Tax Exemption Certificate For Form AGRICULTURAL. Check out the rest of this guide to determine who needs a sales tax permit what. In its most basic form a sales tax exemption certificate alleviates a company from collecting and remitting sales tax on certain products and services.

Meals and Rooms Tax see p. The certificate is also sometimes referred to as a resale permit or a resellers permit. For questions regarding how these exemption certificates may be properly applied please contact the Vermont Department of Taxes at 802 828-2551 option 3.

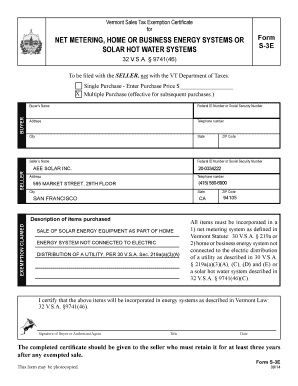

You can download a PDF of the Vermont Streamlined Sales Tax Certificate of Exemption Form SST on this page. This certificate does not require a number to be valid. 9741 3 9741 25 Form S3A To be filed with the SELLER not with the VT Department.

The burden of proof that the tax was not required to be collected is upon the SELLER. Some beverages are sales tax exempt in Vermont but as of July 1 2015 beverages that contain natural or artificial sweeteners are taxed. Companies or individuals who wish to make a qualifying purchase tax-free must have a Vermont state sales tax exemption certificate which can be obtained from the Vermont Department of Taxes.

OFM has compiled relevant state guidance on its website. This exemption certificate applies to the following. Other types of exemption certificates that may be applicable are.

Texas Sales and Use Tax Exemption Certification. Exemption certificates are not filed with the Vermont Department of Taxes but the seller must produce an exemption certificate when it is requested by the Department. Vermont CVR 10-060-023 Reg.

503 ˇ ˆ.

Vt Form S 3c Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Contractors Completing A Qualified Exempt Project Vermont Templateroller

Vermont Tax Exempt Form Agriculture Fill Online Printable Fillable Blank Pdffiller

Vermont Sales Tax Exemption Certificate For Form S

Vt Form S 3 Download Printable Pdf Or Fill Online Purchases For Resale And By Exempt Organizations Vermont Templateroller

Fillable Online Department Of Taxation Sales Tax Exemption Certificate Form S 3e Fax Email Print Pdffiller

Vt Form S 3m Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Manufacturing Publishing Research Development Or Packaging Vermont Templateroller

Vermont Tax Exempt Forms Fill Out And Sign Printable Pdf Template Signnow

Printable Vermont Sales Tax Exemption Certificates

Vermont Sales Tax Exemption Certificate For Form S

Which States Have The Lowest Property Taxes Property Tax American History Timeline Usa Facts

Vt Dot S 3 2003 Fill Out Tax Template Online Us Legal Forms

How To Get A Certificate Of Exemption In Vermont Startingyourbusiness Com

Vt Form S 3e Download Printable Pdf Or Fill Online Vermont Sales Tax Exemption Certificate For Net Metering Home Or Business Energy Systems Or Solar Hot Water Systems Vermont Templateroller

Vermont Sales Tax Exemption Certificate For Form S